Legal Updates

2017 Brings Increases In State Minimum Wage Rates

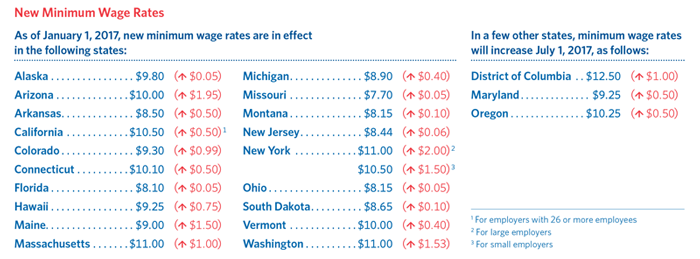

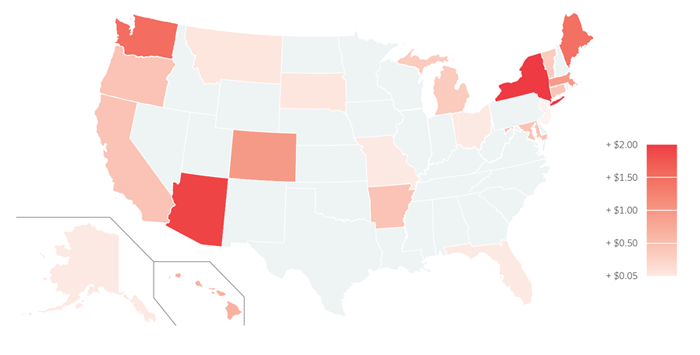

As of January 1, 2017, many states – including Massachusetts – have increased their minimum hourly wage rates. In addition, increased minimum wage rates in several other states will take effect later this year.

Employers operating in states affected by these increases should adjust their payroll practices as necessary and prepare to display the requisite new workplace posters.

Federal And Municipal Minimum Wage Rates

Despite recent campaigns by service employees and worker advocacy groups to increase the federal minimum wage rate, that minimum rate currently remains at $7.25. President-elect Trump and some Republican leaders in Congress, however, have voiced tentative support for a modest hike, so some type of increase in the federal minimum wage rate appears possible.

As of January 1, 2017, federal contractors must pay covered workers at least $10.20 per hour, while covered tipped employees performing work on or in connection with covered federal contracts must be paid a cash wage of at least $6.80 per hour. (These minimum wage rates for federal contractors, however, were adopted under a 2014 executive order issued by President Obama, which the new administration conceivably might modify or rescind.)

Finally, a growing number of municipalities have established their own minimum wage rates in recent years, frequently well in excess of the applicable state minimum wage rates. Thus, businesses that employ workers within such municipalities need to ensure that employees’ wages are consistent with those local minimum wage rates.

Recommendations For Employers

In light of these developments, employers are advised to:

- Update their payroll practices as necessary to comply with recent increases in minimum wage rates;

- Ensure that current versions of all required workplace posters relating to minimum wage rates and other employment matters are displayed in the appropriate locations;

- Carefully review all written job descriptions to ensure that employees are appropriately classified as exempt or non-exempt, and that workers are not improperly treated as independent contractors rather than employees; and

- Continue to monitor developments at the federal, state, and local levels regarding minimum wage rates.

***

Please feel free to contact us if you have any questions regarding recent increases in minimum wage rates or any other wage-and-hour issues.